By The Numbers: It’s a Structural Strain

July 8, 2020

This week’s post is all about the numbers. Our guest writer, Jason Leach, CFA & Director of Finance at Zilis, has put together a comprehensive overview of the CBD and Hemp industry in the U.S. He answers the question of how hemp and phytocannabinoids have become a structural shift in the U.S. economy.

Part I: The Door is Opened – It’s Structural

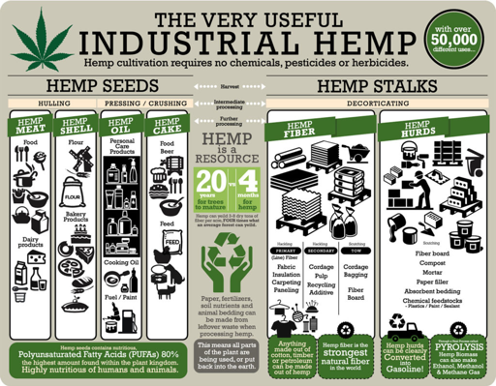

Remarkably, it was only a few short years ago that the 2014 Farm Bill opened the door to the realization of the potential benefits of hemp-based phytocannabinoids for well-being and homeostasis. Out of that seminal achievement, groundwork was laid for the 2018 Farm Bill to catapult hemp and CBD into the mainstream in 2019 (both bills were expertly outlined by Joy Beckerman in previous weeks). We now have a bustling new hemp and hemp-based phytocannabinoid (CBD, CBG, CBC, CBN, etc.) industries using new technologies on an age-old crop with burgeoning possibilities to improve health and wellbeing as well as utilize the hearty plant’s bounty across a range of other industries.

In economics, structural change is defined as change that has a meaningful impact on major parts of an economy. It is safe to say that hemp and phytocannabinoids are part of significant structural change in important parts of the U.S. economy, namely:

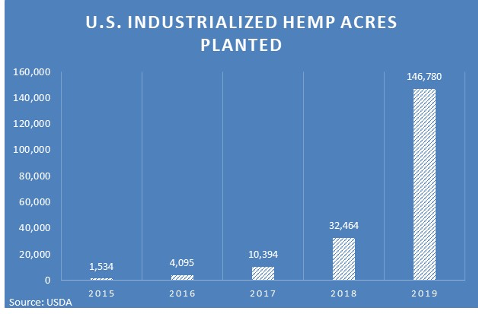

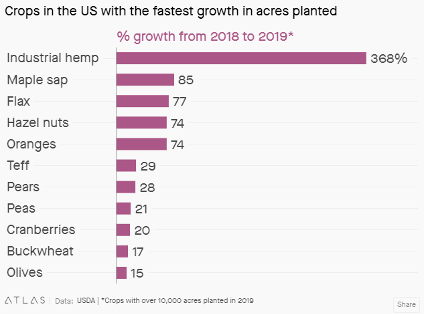

- agriculture, as U.S. farms planted nearly 150,000 industrial hemp acres in 2019 up from 1,500 acres in 2015;1

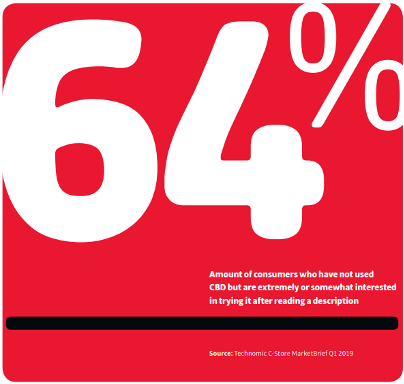

- health and wellness for humans and pets (28% of Americans use CBD daily or as needed2,3 and 64% would like to try CBD,4Whole Foods named hemp a top ten food trend for 2019,5 26% of American adults with pets use CBD6 and 1 in 10 pet owners now gives CBD to their pet regularly7);

- skincare and cosmetics industries (the #1 most desired new natural ingredient in skin care is CBD8); and

- building and manufacturing (environmentally friendly hemp plastics, hempcrete, furniture, autos, and more).

It is reasonably safe to say that there will be few sectors of the economy that will not be touched by hemp in coming years – this is structural change. Said another way, to think that a plant, not legal to be grown in the U.S. just over 6 years ago is now a top ten sales item at Whole Foods is indeed a structural shift.

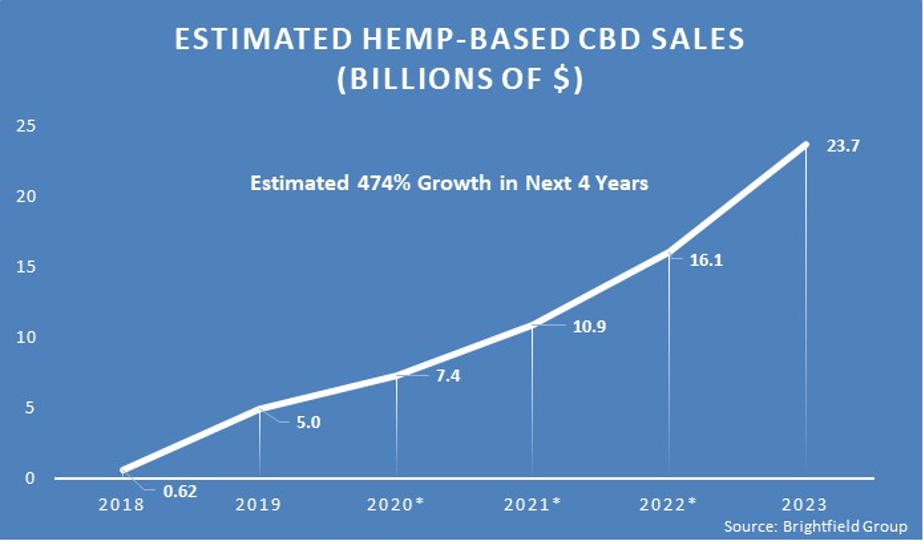

Following the ratification of the 2018 Farm Bill into law in early 2019 (making hemp-derived CBD legal, enabling hemp farmers to apply for crop insurance, and facilitating banking with the hemp industry), hemp-based CBD sales achieved escape velocity. In 2019, the overall U.S. hemp-derived CBD market grew to $4.2 billion, a 562% increase over 2018 ($627 million), and 7,000% growth from $59 million in 2014.9 The Pet CBD market increased 946% in 201910 to an estimated $400 million from $32 million in 2018.11 And in 2019, the CBD skin care and beauty market grew an estimated 1,783% to $311 million from $17 million in 2018, thus garnering 8% share of the overall skin care and beauty care market; remarkable in such a short period of time.

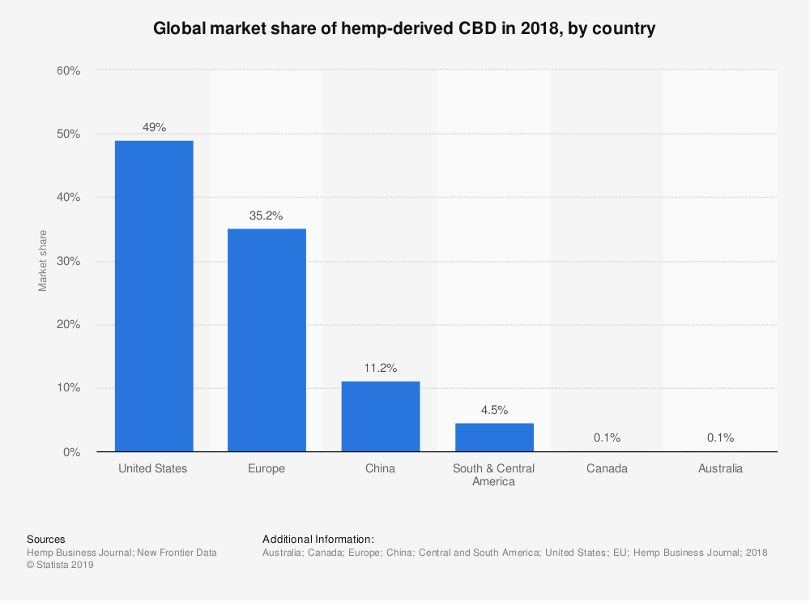

Looking forward, the U.S. hemp-derived CBD market is estimated to grow to nearly $24 billion by 2023, representing 474% overall growth and 107% compound annual growth rate over that period.12 Skin care will likely be driven by inclusion of CBD, and plant-based, sustainability and organic trends. In Europe, the second largest CBD market after the United States, CBD expenditure is estimated at 400% growth over the next four years,13 with 46% of Europeans viewing CBD favorably and 77% believing in access to CBD in some way.14 Back of the envelope, just between the U.S. and Europe, hemp-based CBD sales could approach $50 billion by 2023 – that is a once in a generation type birth of a new industry. Going forward, education is important, as discussed, 64% of consumers who have not used CBD are extremely or somewhat interested in trying it after reading a description,15 or indeed having CBD and its benefits explained to them.

Part II: Pandemics (Past and Present)

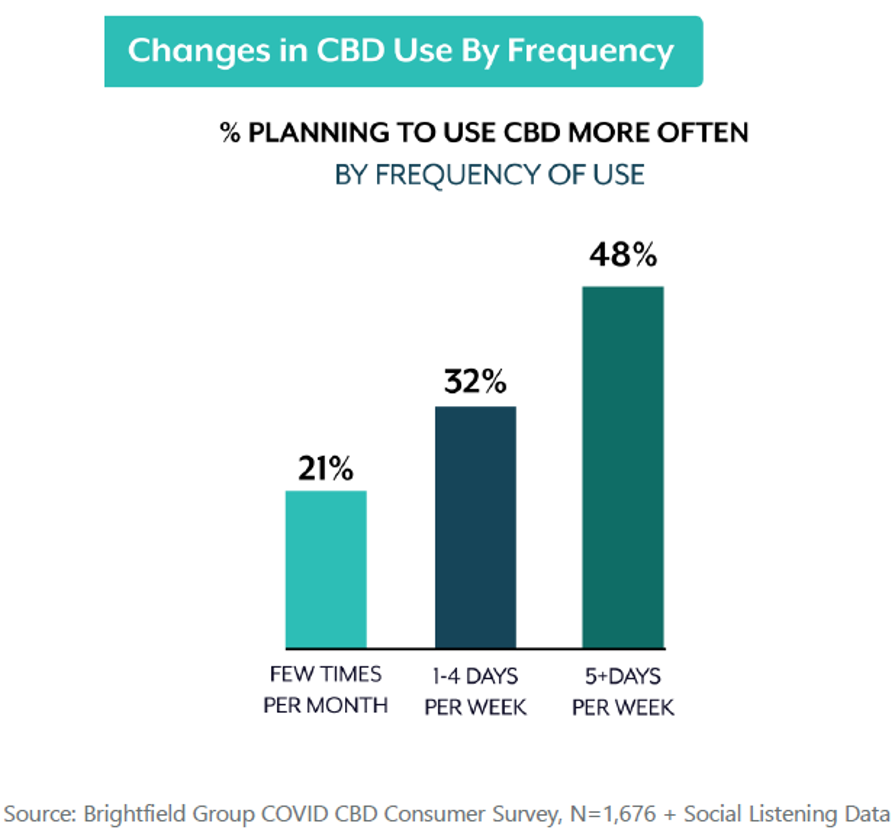

So, it’s structural, hemp-based cannabinoids are here and growing rapidly in use. Recently, the Covid-19 virus pandemic blindsided an unprepared world. What, if any, data is out there on the pandemic’s effect on the U.S. CBD market? Some timely survey data out of Brightfield indicate that existing users plan to markedly increase their frequency of use during the stay-at-home period (which could last beyond the initial wave as working life adjustments continue). Those surveyed who used CBD 5+ days per week indicated a 48% planned increase in use, those 1-4 days indicated a 32% increase, and those who used a few times per month averaged a 21% rise in planned usage. The top five reasons for increased usage were self-care (24%), health (13%), social (12.7%), relaxation (12.3%), and anxiety and stress (10.5%). It appears the pandemic further brought to the fore the benefits of CBD for selfcare.

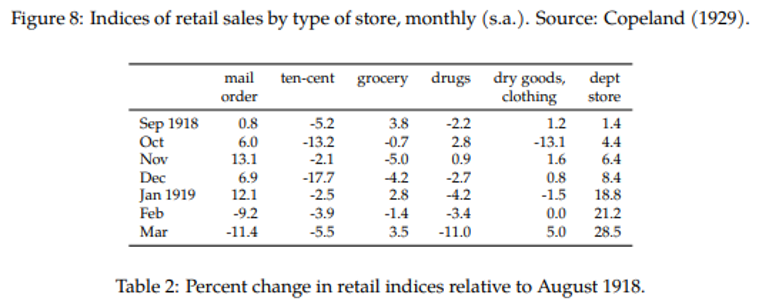

Looking back at the Spanish Flu of 1918-1919, there are several interesting data points to keep in mind today. First, there was an “Amazon Effect” or direct to consumer effect, in 1918 as there is in 2020. The Federal Reserve Bank of Chicago noted in an April 2020 paper that mail order retail sales (e.g., Sears & Roebuck, Montgomery Ward) increased up to 13% during the Winter of 2018.16 Similarly, 100 years later, one third of CBD purchasers planned to switch to online purchases, with additional one third considering the move, or two thirds of CBD purchasers either planning or considering switching to online purchases. The shift to direct to consumer in 2020 and beyond may be much stickier than 1918-1919 as:

- the U.S. is 83% urban vs. 50% in 1918 (closer populations require shutdowns);

- 10% of the economy today is agriculture and manufacturing vs. 51% in 1918 (digital and indoor vs. smokestack and outdoor work requiring leaving home); and

- non-pharmaceutical interventions (NPI) such as shutting down non-essential businesses (retail) and stay at home orders are being more strongly and broadly enforced today than in 1918.

Maybe the most important contradistinction is that direct to consumer was not convenient in 1918 – it was a mail order, weeks of waiting last resort – and thus not “sticky” after the pandemic passed. In 2020, digital, phone-enabled direct to consumer is convenient, first choice, and very sticky. Going forward, online direct to consumer hemp-based phytocannabinoid purchases are likely to be a growing part of the fast-growing hemp-based industry.

Part III: What Comes Next?

“We’ve had a fast pandemic (COVID) on top of a slow pandemic (poor health).” – Anonymous

Following World War I and the Spanish Flu pandemic of 1918-1919, the decade of the 1920s was one of the most innovative and prosperous decades in American history. The “Roaring 20s” was a period of dramatic change that transformed the fundamental structure of the U.S. economy with widespread adoption of household electricity, automobiles, the radio, telephone, and great advances in mechanized manufacturing and agriculture among many other inventions and innovations.17 As I like to put it, there was a dramatic “reorganization of thinking” following war and pandemic, embracing new technologies, electrification, communication, motorized transport, and a more urban lifestyle that was completely foreign just a decade earlier. Similarly, today, with structural changes such as hemp and CBD, artificial intelligence, 5G, genomics, digital currencies, sustainability, organic, gig work and second incomes, there is “Roaring 20s” style structural reorganization going on. As one commentator said, “we’ve had a fast pandemic (the virus) on top of a slow pandemic (decades of poor diet and associated heart disease and diabetes making people more susceptible to adverse outcomes from COVID-19).” Going forward, there needs to be a reorganization of thinking around diet and health; and hemp and hemp-based phytocannabinoids such as CBD, as well as other health support supplements, will be a structural part of that conversation.

Don’t miss our next post from guest writer Kerrie Suits on how botanicals activate our ECS!

[1] Crop Acreage Data. (2020). Retrieved June 26, 2020, from https://www.fsa.usda.gov/news-room/efoia/electronic-reading-room/frequently-requested-information/crop-acreage-data/index

[2 , 6] New Acosta Report Find 28 Percent of Consumers Use CBD Products Daily or As-Needed. (2019, September 10). Retrieved June 26, 2020, from https://www.acosta.com/news/new-acosta-report-finds-28-percent-of-consumers-use-cbd-products-daily-or-as-needed

[3] Consumer awareness and consumption of CBD in the United States in 2019 (Rep.). (2019, May). Retrieved June 26, 2020, from Statista website: https://www.statista.com/statistics/1006328/consumer-awareness-of-cbd-us/

[4 , 15] Abcede, A., Dworski, B., & Lancaster, A. (2019, May 16). Is CBD the Next Big Thing? Retrieved June 26, 2020, from https://www.cspdailynews.com/cbd-cannabis/cbd-next-big-thing

[5] Whole Foods Market unveils top 10 food trends for 2019. (2018, November 15). Retrieved June 26, 2020, from https://media.wholefoodsmarket.com/news/whole-foods-market-unveils-top-10-food-trends-for-2019

[7] Dorbian, I. (2020, February 18). New Report Reveals Huge Market For CBD Pet Products. Retrieved June 26, 2020, from https://www.forbes.com/sites/irisdorbian/2020/02/18/new-report-reveals-huge-market-for-cbd-pet-products/

[8] Natural attributes in skin care products which consumers want to buy in the United States as of 2019 (Rep.). (2019, June). Retrieved June 26, 2020, from https://www.statista.com/statistics/1077762/natural-attributes-in-skin-care-products-consumers-willing-to-buy-in-the-us/

[9] Cannabidiol Market Size, Share & Trends Analysis Report By Source Type (Hemp, Marijuana), By Distribution Channel (B2B, B2C), By End Use, By Region, and Segment Forecast, 2019-2025 (Rep.). (2019, December). Retrieved June 26, 2020, from https://www.grandviewresearch.com/industry-analysis/cannabidiol-cbd-market#:~:text=Report%20Overview,22.2%25%20from%202019%20to%202025

[10] The pet CBD category grew 946% in 2019 [Brightfield Group Report]. (2020). Retrieved June 26, 2020, from https://www.brightfieldgroup.com/pet-cbd-landscape

[11] Schau, J. (2019, August 08). Projections: Pet CBD Marches Toward the Mainstream. Retrieved June 26, 2020, from https://www.cannabisbusinesstimes.com/article/pet-cbd-products-treats-mainstream/

[12] Dollar sales of cannabidiol (CBD) products in the United States from 2018-2023 (Rep.). (2019, November). Retrieved June 26, 2020, from https://www.statista.com/statistics/1067467/cbd-product-dollar-sales-us/

[13] Germany To Drive Huge EU CBD Growth. (2020, April 30). Retrieved June 26, 2020, from https://www.cbdvillage.co.uk/lifestyle/news/germany-to-drive-huge-eu-cbd-growth

[14] Price, S. (2020, February 25). CBD market on course to grow 400% in Europe alone . Retrieved June 26, 2020, from https://www.healtheuropa.eu/cbd-market-to-grow-400-in-europe/98021/

[16] Velde, F. (2020, April). What Happened to the US Economy During the 1918 Influenza Pandemic? A view through high-frequency data (Working paper No. 2020-11). Retrieved June 26, 2020, from Federal Reserve Bank of Chicago website: https://www.chicagofed.org/publications/working-papers/2020/2020-11

[17] The Soaring Twenties. (2013, June 19). Retrieved June 26, 2020, from https://www.forbes.com/2009/07/28/great-depression-roosevelt-hoover-opinions-columnists-thomas-f-cooley.html

About Zilis’ Scientific Research & Development Department

Our Scientific Research and Development Department is headed up by Dr. Marielle Weintraub, a hemp industry expert. She holds a master’s and a PhD in Behavioral Neuroscience and is very active in many dietary supplement and hemp industry trade associations, including her role as the current President of the U.S. Hemp Authority. Dr. Weintraub is committed to the continued development of hemp-specific information and testing to fulfill the Zilis mission.

Science posts for Discover are co-researched and co-written by Kelly McGill, Senior Scientific Technical Writer at Zilis. Kelly holds a bachelor’s degree in English and a master’s in Linguistics / TESL. She has been writing science-related content for over 20 years and is an expert in making difficult concepts easy to understand.

Zilis is the creator of UltraCell™, a CBD oil product derived from hemp. Based in Argyle, Texas, a suburb of Dallas-Fort Worth, Zilis is privately held. Visit zilis.com for more information.

SHARE THIS POST

ABOUT THIS BLOG

Discover : The blog with the lifestyle, nutrition, science, and history of the hemp industry.

It’s your go-to for the most up-to-date information on hemp, CBD, dietary supplements, and more! Check it out!